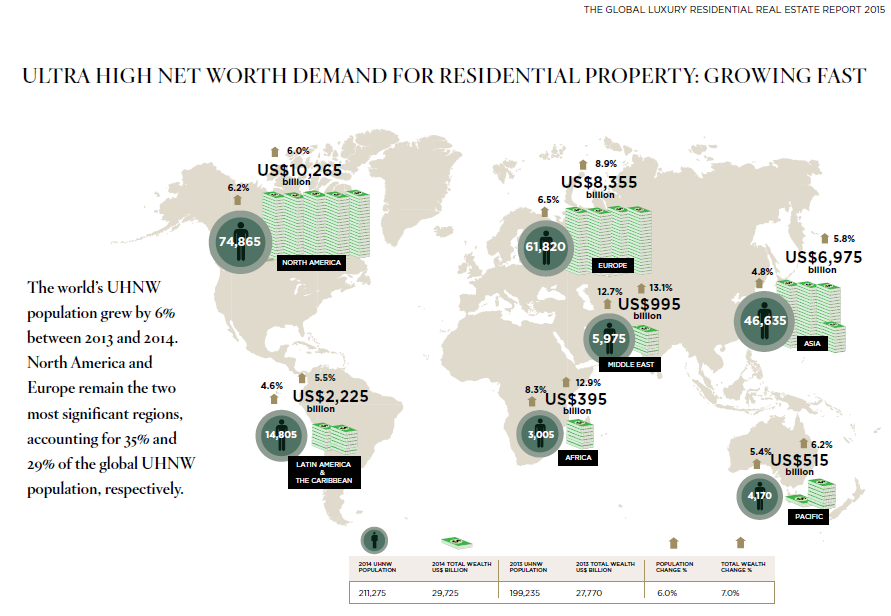

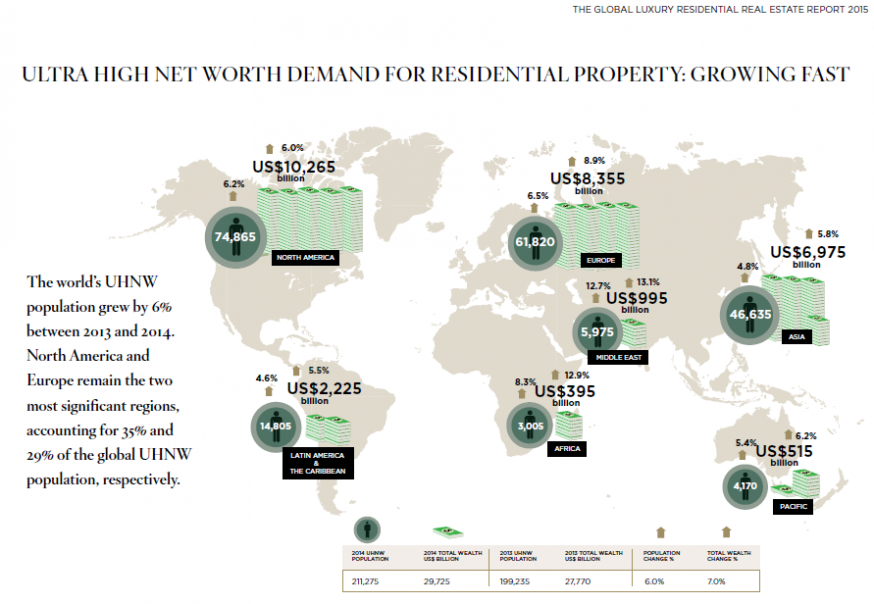

According to a new report by Wealth-X and the Sotheby’s International Realty® brand, nearly US$3 trillion of the world’s private wealth is held in owner-occupied residential properties, a value greater than the GDP of India. There are 211,275 ultra high net worth (UHNW) individuals – defined as those with US$30 million and above in net assets – in the world, and 79% of them own two or more residences. Some of the main hubs for luxury residential real estate are New York City, London and Hong Kong, but niche locations – such as Lugano, the Hamptons outside New York City, and rural areas around the world – are gaining in popularity.

The Wealth-X and Sotheby’s International Realty Global Luxury Residential Real Estate Report forecasts that the ongoing shift in the wealth creation cycle from the West to the East, and the growing significance of intergenerational wealth transfers, will have significant consequences on the luxury residential real estate market – with a noted emphasis on new developments and a change in investment grade cities. The 2015 report looks at trends in the UHNW population’s appetite for luxury residential real estate across the world, and identifies specific attitudes, behaviors and locations that matter to this industry and this wealth segment.

Wealth-X President David Friedman commented: “Wealth-X is pleased to partner with the Sotheby’s International Realty brand for this inaugural report, which underscores Wealth-X’s commitment to conducting groundbreaking research on the world’s ultra high net worth (UHNW) population. Expert commentary from the Sotheby’s International Realty team complements Wealth-X’s global intelligence on the world’s UHNW population, producing a report that demonstrates a true collaboration between the world’s leading UHNW intelligence provider and the global leader in luxury residential real estate. Luxury residential property is a core component to the anatomy of the ultra affluent at the intersection of their lifestyle and investment.”

“This research offers an inside look into the global luxury real estate market,” said President and CEO Paul Breunich. “This study adds to our knowledge of our local markets, including Westchester County, N.Y., Connecticut and the Berkshires, Mass., by providing valuable details on many far-reaching markets, which helps inform our clients’ decisions on where to invest on a global basis.”

Download the report here.